workers comp taxes for employers

For information to start a small business call the Business One-Stop Shop Office at 833-722-6778. IRS forms and tax returns such as W-2s 1099s and.

Fica Taxes Unemployment Insurance Workers Comp For Owners

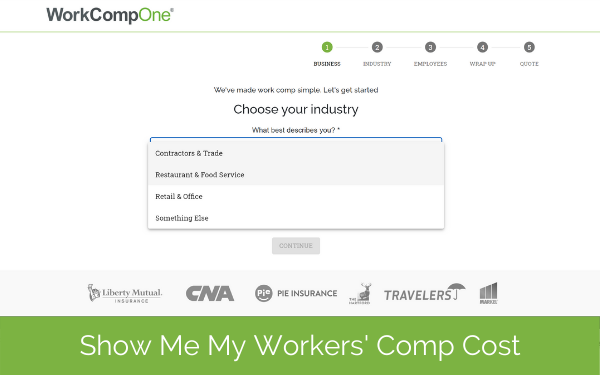

For over a century weve been providing Americas small businesses with cost-effective workers compensation insuranceWith our emphasis on financial stability and fast efficient claims service we now serve clients in 46 states and the District of ColumbiaEMPLOYERS remains focused on keeping Americas Main Street.

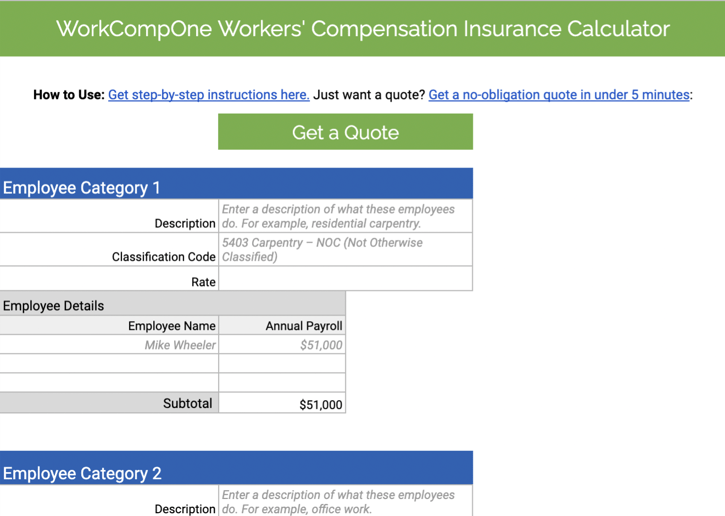

. Once you have the estimated annual payroll for the employee divide that number by 100. Each employers premium is based on rates for different job categories that are multiplied by. The system strikes a compromise between employers and employees.

You then multiply that number by the premium rate for the class code to find the total cost of. In that sense workers comp is in the same. If an employer sends you a 1099 for workers compensation payments they made a.

Its the first time in 5 years that workers compensation rates have gone up but on average premiums in 2022 would still be less than in 2017. Compassion Professionalism Respect and the Compensation You Deserve. However you can also claim a tax credit of up to 54 a max of 378.

Workers compensation payouts are not taxed so the employer doesnt have to create a record for the IRS by issuing a 1099. So if a worker makes 10 an hour their base but they work overtime at 15 an hour you only owe workers comp on the 10 rate for those extra hours. New York law states that if an employer provides workers compensation benefits for on-the-job injuries the employees cannot sue the employer or co-workers for those same injuries.

Under the workers compensation system in almost every state in the US most employers are required to purchase insurance that provides a range of benefits to employees who are injured or become ill because of their jobs. Any workers comp payments and benefits that employers pay to their workers is a deductible business expense. The 31 overall average rate increase is driven by cost-of-living adjustments for pensions which were triggered by an increase in the states average wage.

A portion of an employees workers compensation can become taxable if they collect SSDI benefits and receive more than 80 of their average current earnings. Whether you pay Ohio BWC KEMI or popular private carriers like Travelers or Liberty Mutual one thing that is common across the board for work comp insurance is that your insurance premium looks more like a payroll tax then an insurance bill. Payment is due by the last day of the month following the end of the quarter.

For additional guidance regarding Unemployment Insurance please contact the Unemployment Department at 307-235-3217. If an employee qualifies for workers comp they may be able to have their wages and essential medical benefits covered through the insurance. Employers can typically claim the full.

Yes workers comp is taxable. An employer s tax is determined by multiplying his experience rate which is the same rate used for the general unemployment compensation tax by the revenue ratio the rate the state treasurer determines is needed to raise funds sufficient to meet the annual bond debt service and multiplying the total rate by the employer s taxable wage. It doesnt matter if your settlement is in a lump sum or structured to pay benefits over a period of time.

Visit the web for other workers compensation informational material including the PA WC Annual Report the most frequently asked workers compensation questions and safety committee information. This is an average meaning some employers. Workers compensation for an occupational sickness or injury if paid under a workers compensation act or similar law.

Is workers comp taxable. For unemployment tax purposes domestic employers do not include non-cash compensation ie room and board as wages. Employees get benefits.

For additional guidance regarding Workers Compensation please contact our Employer Services Department at 307-777-6763 or email DWS-wcemployerserviceswyogov. When an employee suffers a workplace-related illness or injury workers compensation can help soften the blow at least financially. Section 42-1-450 allows injured.

Wages and salaries including retroactive pay compensation added to a paycheck if an employee was underpaid for some reason Overtime or double time pay at the employees base rate. Workers Comp tax is something that HR and Accounting Departments have to consider overall. Up to 25 cash back master2022-04-19_10-08-26.

Required to provide workers compensation coverage for each employee working on the public project. IF YOU ENCOUNTER ANY ERROR MESSAGES DURING REGISTRATION. The employer must obtain a workers compensation insurance policy.

Once you come to the end of your year policy your final workers comp rate can be adjusted to account for initial over- or under-estimated payroll projections. Contractors and subcontractors to carry workers compensation coverage. Despite pain and suffering the law prevents employees from suing their employers for on-the-job injuries.

The fee for covered employees working on the last day of the quarter is 200. A Workers Compensation Insurance Company. Ad Pay Nothing Upfront.

No you do not receive a 1099 for workers compensation. As an employer who provides workers comp insurance an employee ordinarily cannot sue you for damages relating to a workplace injury or illness. In some states you can buy coverage through a private insurance company but in most states you must pay workers comp taxes through the state.

FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. The relationship liability may be described as upstream in which injured workers may seek relief for workers compensation damages from their deemed employer as if the worker was an immediate employee. Domestic employers are required to cover employees once the employees are paid cash wages of 1000 or more in total payroll in a calendar quarter in either the current or preceding calendar year.

Since having workers comp insurance is necessary for running a business business owners are able to deduct the costs of required insurance payments from their taxes. Most businesses participate in the states workers compensation program. Our Services are Completely Free Until You Recover Compensation.

WC tax comes up each year as the end of our tax filing season. Generally employers must provide workers compensation industrial insurance coverage for their employees and other eligible workers. There are two ways to provide this coverage depending on the financial resources of your business.

Workers compensation insurance. Workers comp pays at most 23 of an employees. The standard FUTA tax rate is 6 so your max contribution per employee could be 420.

The fee for the employer is 230 times the number of covered employees working on the last day of the quarter. The IRS manual reads. Some clients may also require their contractors to have workers compensation insurance.

Providing Workers Compensation Insurance If employers choose to provide workers compensation they must do so in one of the following ways. Workers compensation pays for benefits in case an employee files a claim under workers comp due to a work-related illness or on-the-job injury. The following payments are not taxable.

Permanent Disability Pay In California Workers Comp Cases 2022

Are Workers Comp Benefits Adequate Legal Talk Network

How To Calculate Workers Compensation Cost Per Employee Pie Insurance

Workers Compensation And Taxes Phalenlawfirm Com Ks And Molaw Office Of Will Phalen

Workers Comp Is Never Off The Clock

Is Workers Comp Taxable Workers Comp Taxes

Workers Compensation Insurance Cost Calculator How Much For A Small Business Policy

How To Understand Workers Comp Codes In Louisiana Canal Hr

How To Calculate Workers Compensation Cost Per Employee

Workers Compensation Insurance Overview Amtrust Financial

Is Workers Comp Taxable Hourly Inc

When Does Workers Comp Start Paying After A Workplace Injury

Is My Workers Comp Taxable Ksa Insurance

What Wages Are Subject To Workers Comp Hourly Inc

How A Worker S Comp Settlement Is Calculated Bdt Law Firm

The Workers Compensation Notice Employers Resource

Texas Workers Compensation Laws Costs Providers

Costratesadvisor Com Payroll Analysis Report Workers Comp Insurance Analysis Payroll Taxes